45 suppose you bought a bond with an annual coupon of 7 percent

Chapter 7 You'll Remember | Quizlet Suppose that today you buy a bond with an annual coupon of 7 percent for $1,090. The bond has 14 years to maturity. A) What rate of return do you expect to earn on your investment? Assume a par value of $1,000. B) What is the HPY on your investment? (your realized return is known as the holding period yield) Purchasing Power Parity Formula | Calculator (Excel Template) Suppose US dollar is equal to 60 Indian rupees. ( 1$ = 60). Now, consider that an American visited India for the first time. He purchased ten cupcakes for Rs 120. He found the cupcakes cheaper here, as in the US, he had bought similar cupcakes for $3. So here, $3 = 180. For Rs 180, he would be able to buy 15 cupcakes in India.

Chapter 7 Homework.docx - 2- Suppose you buy a 7 percent... View Homework Help - Chapter 7 Homework.docx from FINANCE 301 at Loyola University Chicago. 2- Suppose you buy a 7 percent coupon, 20-year bond today when it's first issued. If interest rates. Study Resources. Main Menu; by School; by Literature Title; by Subject; ... 2- Suppose you buy a 7 percent coupon, 20-year bond today when it's first ...

Suppose you bought a bond with an annual coupon of 7 percent

Applied Mathematics assignment help online ? - Essay Help Mar 21, 2022 · Combine like terms. 27. 5x + 14y – 3z – x + 2y 28. (-7+4)m – (15-2)m + -2m; Provide Citation. You have been assigned as a Data Scientist for the XYZ company. Suppose you are using a Logistic Regression model on a huge dataset. One of the problems you are going to face on such… (a) Find P(I(i, j). Geometric pairs. Question : Question Suppose you buy a 7 percent annual coupon bond ... Suppose you buy a 7 percent annual coupon bond today for $960.The bond has 6 years to maturity. The face value of the bond is$1,000. What is the YTM of the bond? Assume that your investmenthorizon is equal to the duration of the bond. Two years from now,the YTM on your bond has decreased by 50 basis points. Answered: Consider a coupon bond with a 5% coupon… | bartleby Q: Suppose a bond has a face value of $3,000, 10 years to maturity, an annual coupon of 7%, and sells… A: 1) Face value = $3000 Selling price = $2800 Duration till maturity (n) = 10 years Coupon = 7% of…

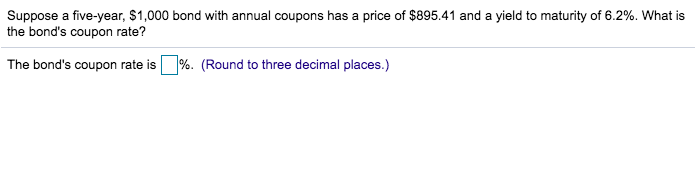

Suppose you bought a bond with an annual coupon of 7 percent. Are You A Real Millionaire? $3 Million Is The New $1 Million 13.05.2021 · Although being a millionaire sounds nice, it's not that impressive anymore thanks to inflation. In order to be a real millionaire, you will need to have a net worth of at least $3 million, not $1 million. A $1 million net worth provided a great lifestyle before 1990. Not so much today largely thanks to inflation. If you retired today at 65 with $1 million, you may be able to spend … Answered: Suppose you buy a bond with a coupon of… | bartleby Business Finance Q&A Library Bond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules: IF c = r ... FIN 3320 Connect CH7 Flashcards | Quizlet Bourdon Software has 9.6 percent coupon bonds on the market with 20 years to maturity. The bonds make semiannual payments and currently sell for 107.6 percent of par. ... Current yield = Annual coupon payment / Price Current yield = $96 / $1,076 Current yield = .0892, or 8.92% ... Suppose the real rate is 3.5 percent and the inflation rate is 5 ...

Twitpic Dear Twitpic Community - thank you for all the wonderful photos you have taken over the years. We have now placed Twitpic in an archived state. For more information, click here. Chapter 7 Interest Rates And Bond Valuation - Quizlet Sunset Sales has 7.2 percent coupon bonds on the market with 11 years left to maturity. The bonds make semiannual payments and currently sell for 98.6 percent of par. ... Suppose that today you buy a 9 percent annual coupon bond for $1,000. The bond has 12 years to maturity. Three years from now, the yield-to-maturity has declined to 7 percent ... Answered: Bond valuation) A bond that matures in… | bartleby Bond valuation) A bond that matures in 15years has a $1,000 par value. The annual coupon interest rate is 13 percent and the market's required yield to maturity on a comparable-risk bond is 14 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? The ... Answered: Suppose you bought a bond with an… | bartleby Q: Brown Enterprises' bonds currently sell for $1,025. They have a 9-year maturity, an annual coupon of... A: Yield to Maturity Formula of a bond refers to the total return which is anticipated on the bond in c...

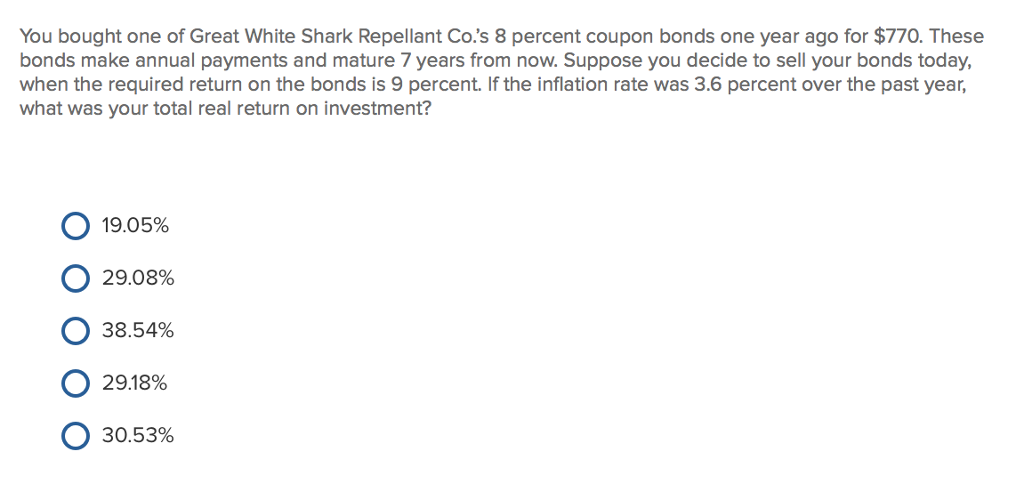

Marketing Management - Kotler - Academia.edu Enter the email address you signed up with and we'll email you a reset link. FRL 300 Final Ch 7 Flashcards | Quizlet A U.S. Treasury bond that is quoted at 100:11 is selling: E. for 100 and 11/32nds percent of face value. Global Communications has a 7 percent, semiannual coupon bond outstanding with a current market price of $1,023.46. The bond has a par value of $1,000 and a yield to maturity of 6.72 percent. Suppose you bought a bond with an annual coupon rate of 7.5 percent one ... Suppose you bought a bond with an annual coupon rate of 7.5 percent one year ago for $898. The bond sells for … Get the answers you need, now! You bought one of Elkins Manufacturing Co.'s 7.8 percent coupon... You bought one of Elkins Manufacturing Co.'s 7.8 percent coupon bonds one year ago for $1,061. These bonds make annual payments, mature 12 years from now, and have a par value of $1,000. Suppose you decide to sell your bonds today, when the required return on the bonds is 4.5 percent.

Managerial Accounting?? - Essay Help 22.03.2022 · On June 30 of the current year, Blue Ridge Power issued bonds with a $40,000,000 face value and an annual coupon rate of 9 percent. The bonds mature in 10 years and pay semiannual interest on December… Birch Company has $12,000 at June 1. The company also anticipates $30,000 in cash receipts and $34,500 in cash disbursements for the month of ...

Solved Suppose you bought a bond with an annual coupon rate - Chegg a. Assuming a $1,000 face value, Question: Suppose you bought a bond with an annual coupon rate of 7.4 percent one year ago for $900. The bond sells for $940 today. a.

Suppose you bought a bond with an annual coupon of - SolutionInn Suppose you bought a bond with an annual coupon of Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today.

Bear markets: how long they last and how to invest during one 28.06.2022 · This gilt will mature in 22 years. When it does so, you’ll get £100 back (the face value of the bond). You’ll note from the Hargreaves Lansdown page however that the gilt is currently priced at £109.65. This means you are GUARANTEED to lose capital if you buy this bond today and hold it until 2042. You buy it for £109.65. Between now and ...

(PDF) General Mathematics Learner's Material Department of … This learning resource was collaboratively developed and reviewed by educators from public and private schools, colleges, and/or universities. We encourage teachers and other education stakeholders to email their feedback, comments and

Answered: Consider a coupon bond with a 5% coupon… | bartleby Q: Suppose a bond has a face value of $3,000, 10 years to maturity, an annual coupon of 7%, and sells… A: 1) Face value = $3000 Selling price = $2800 Duration till maturity (n) = 10 years Coupon = 7% of…

Post a Comment for "45 suppose you bought a bond with an annual coupon of 7 percent"