41 zero coupon bonds risk

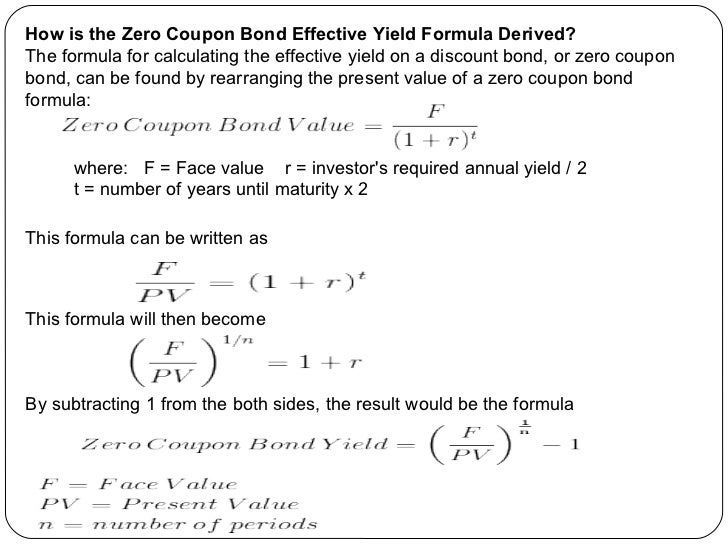

Zero Coupon Bond (Definition, Formula, Examples, … Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia Zero-Coupon Bonds can render great returns if used strategically for your investment goal. In absence of any exceptional case, like intermittent coupon payments, Zero- Coupon Bond's yield to maturity is calculated as: Yield = (FV/PV) 1/n - 1 Where, FV = Face value PV = Present Value n = number of periods Example

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero coupon bonds risk

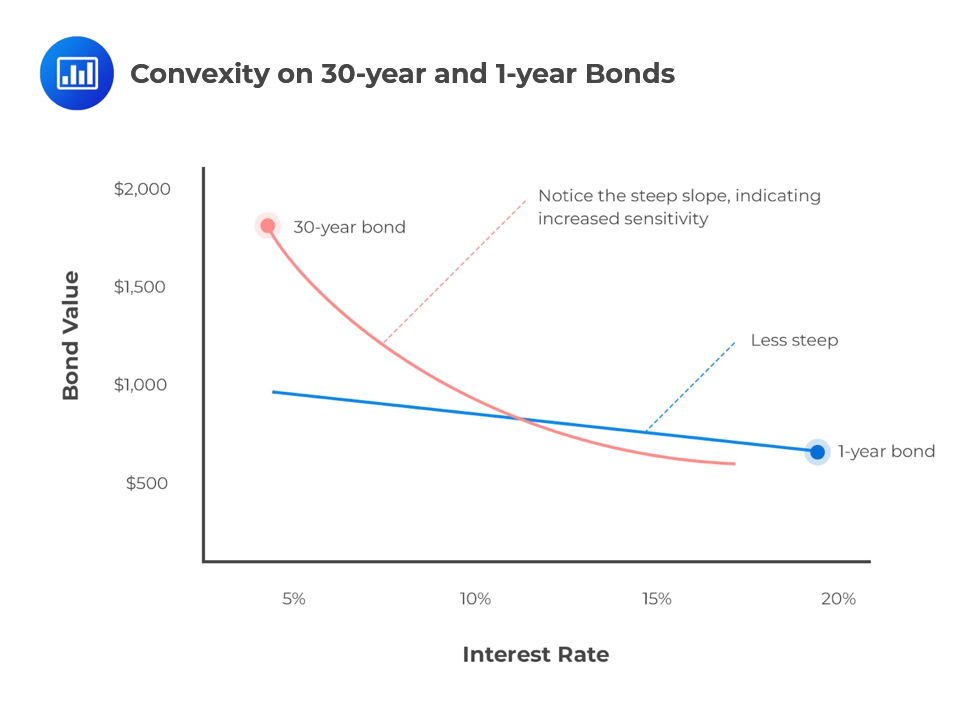

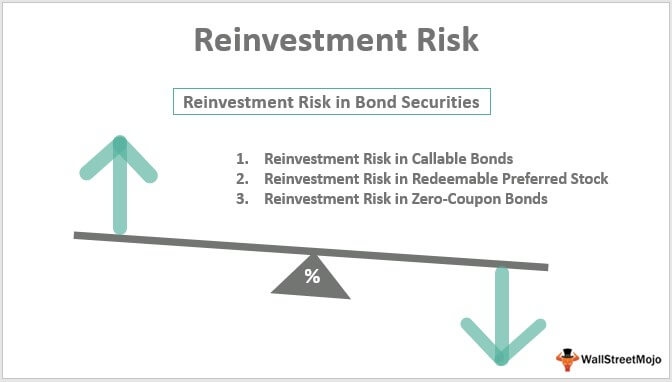

Zero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Risks Interest Rate Sensitivity One drawback to zero-coupon bonds is their pricing sensitivity based on the prevailing market interest rate conditions. Bond prices and interest rates have an “inverse” relationship with one another: Declining Interest Rates Higher Bond Prices Rising Interest Rates Lower Bond Prices

Zero coupon bonds risk. Advantages and Risks of Zero Coupon Treasury Bonds 25.06.2013 · Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly... Why do zero coupon bonds have higher interest rate risk than bonds that ... Zero coupon bonds are more sensitive to changes in interest rates than bonds paying a coupon because the duration of a zero coupon bond is generally going to be higher than it would be for a bond of the same investment with the same term to maturity. Many people confuse bond duration with term to maturity, but they are not the same thing at all. How to Invest in Zero-Coupon Bonds - US News Money Zeros are purchased through a broker with access to the bond markets, or with an actively managed mutual fund or and index-style product like an exchange-traded fund. PIMCO 25+ Year Zero Coupon US ... How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds are issued by the Treasury Department, corporations and municipalities. The bonds are considered a low-risk investment compared to stocks, commodities and derivatives. Step 1

What Is a Zero-Coupon Bond? Definition, Characteristics & Example The longer the time until a bond matures, the riskier it is, so generally, bonds with longer terms sell at steeper discounts (i.e., have higher yields). Typically, the following formula is used to... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Higher Risk: It is important to know that companies that float zero-coupon bonds do not have to pay any periodic interest on their money. This often means that these companies tend to make riskier investments. Also, since the bonds have to be repaid long term, there is a huge risk involved that the company may not survive long term. It is for this reason that investors prefer … Zero Coupon Bonds- Taxability under Income Tax Act, 1961 Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. Understanding Zero Coupon Bonds - Part One - The Balance Risk of Default Corporate zero coupon bonds carry the most risk of default and pay the highest yields. Many of these have call provisions. How big of a discount will you pay? Here is an example of how zero coupon bond prices can change: For example, assume that three STRIPS are quoted in the market at a yield of 6.50%.

Zero-Coupon Bonds: Definition, Formula, Example, … Disadvantages of Zero-Coupon Bonds. However, there are also certain drawbacks of zero-coupon bonds that need to be included in the analysis: With zero-coupon bonds, the bondholders need to pay taxes associated with interest income, regardless of the fact that the particular gain has been realized or not. For example, with a bond that is maturing in 5 years, the lump sum return is … Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Some investors avoid paying … Do zero-coupon bonds have interest rate risk? - Quora Which is considered to be risky a 10-year coupon bond or a 10-year zero coupon bond? It depends on what you mean by risk. The price of the zero is likely to be more volatile, but the total return you will earn if you hold it to maturity is known with 100% certainty. So there is interim price volatility, but no risk at all if you hold to maturity. Risk-Neutral Pricing Formula for Zero-coupon bonds with Default Risk ... 1 Answer Sorted by: 1 A brief educational note and then where you can find the info... As a first step, set the expected payoff equal to 0 where prob_D = probability of default, cur_Px = current price, mat_Px = maturity payment, and R = recovery. Therefore prob_D * (recovery - cur_Px) + (1 - prob_D) * (mat_Px - cur_Px) = 0 results in

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-Coupon Bond Definition - Investopedia Zero-coupon bonds are like other bonds, in that they do carry various types of risk, because they are subject to interest rate risk if investors sell them before maturity. How Does a Zero-Coupon...

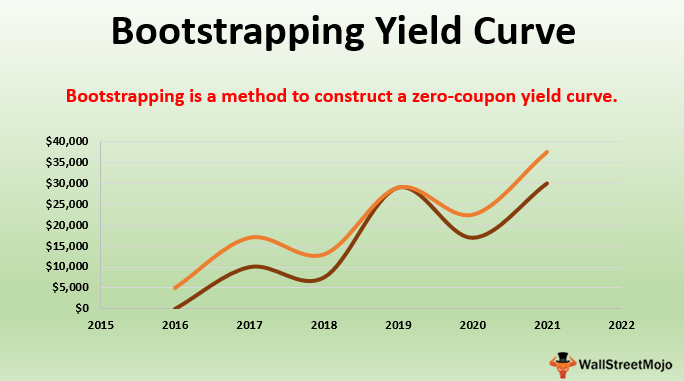

Mapping Zero-coupon Bonds to Risk Factors - Finance Train The first coupon is sensitive to the 6-month interest rate, the next coupon is sensitive to the one-year interest rate, and the last (10th) payment will be sensitive to the 5-year zero-coupon interest rate. For the purpose of mapping each cash flow, the risk manager will need to identify a set of zero-coupon bonds at different maturities. J.P. Morgan suggests 14 different maturities, …

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Also, zeros may not keep pace with inflation. And while …

Zero Coupon Muni Bonds - What You Need to Know The problem with traditional bonds is that investors must reinvest the semiannual interest payments at potentially lower interest rates. Since investors can lock in a specific rate of return with zero coupon bonds, they are spared from worrying about reinvesting the capital at a later date and thereby avoid any reinvestment risks.

Corporate bond - Wikipedia In this case the bond, a zero-coupon bond, is sold at a discount (i.e. a $100 face value bond sold initially for $80). The investor benefits by paying $80, but collecting $100 at maturity. The $20 gain (ignoring time value of money) is in lieu of the regular coupon. ... Supply Risk: Heavy issuance of new bonds similar to the one held may ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ...

The Pros and Cons of Zero-Coupon Bonds - Financial Web Zero-coupon bonds are a type of bond that does not pay any regular interest payments to the investor. Instead, you purchase the bond for a discount and then when it matures, you can get back the face value of the bond. ... Another problem with zero coupon bonds is that they have a higher default risk than traditional bonds. The reason behind ...

Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ...

What Is a Zero-Coupon Bond? Definition, Advantages, Risks As a result, zero-coupon bond prices are more volatile — subject to greater swings when interest rates change. You have to pay taxes on income you don't get Even though you're not actually getting...

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Risks Interest Rate Sensitivity One drawback to zero-coupon bonds is their pricing sensitivity based on the prevailing market interest rate conditions. Bond prices and interest rates have an “inverse” relationship with one another: Declining Interest Rates Higher Bond Prices Rising Interest Rates Lower Bond Prices

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration.

Post a Comment for "41 zero coupon bonds risk"