41 payment coupon for irs

Treasury Payments | U.S. Department of the Treasury Get My Payment. Find information about the Economic Impact Payments (stimulus checks), which were sent in three batches over 2020 and 2021. Assistance for American Families and Workers. Find information about Economic Impact Payments, Unemployment Compensation payments, Child Tax Credit payments, and Emergency Rental Assistance payments. PDF 2021 Payment Coupon (IL-501) and Instructions - Illinois mail Form IL-501 if you electronically pay or are reporting a zero amount. Illinois Department of Revenue. Payment Coupon. IL-501. more information. Do not . make a payment or submit an IL-501 Payment Coupon if no Illinois income tax was withheld. When is income tax considered withheld? In Illinois, income tax is considered withheld

IRS payment options | Internal Revenue Service For more information, go to Pay by Check or Money Order on IRS.gov. 2020 Estimated Tax Payments - Taxpayers making their 2020 estimated tax payment by check, money order or cashier's check should include the appropriate Form 1040-ES payment voucher. Indicate on the check memo line that this is a 2020 estimated tax payment. Paying by cash ...

Payment coupon for irs

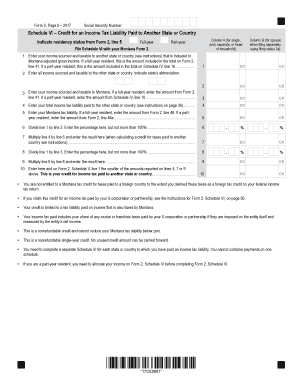

3 Ways to Set Up a Payment Plan with the IRS - wikiHow Generally, you must pay the full amount you owe to the IRS in less than 120 days. 2. Gather the information you'll need to apply online. The payment agreement requires you to provide information about yourself that will help the IRS to locate your tax account and the particular return you want to set up a payment plan for. PDF Draft 2021 Form 760-PMT, Payment Coupon - Virginia Tax Effective for payments made on and after July 1, 2021, individuals must submit all income tax payments electronically if any payment exceeds $2,500 or the sum of all payments is expected to exceed $10,000. This includes estimated, extension, and return payments. Visit our website at for information on electronic payment ... savingtoinvest.com › irs-refund-schedule-and2022 IRS Refund Schedule and Direct Deposit Payment Dates ... Apr 15, 2022 · The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start of the current tax season. It is organized by IRS’ WMR/IRS2Go processing status. The dates are just week ending estimates and should not be construed as official IRS payment dates.

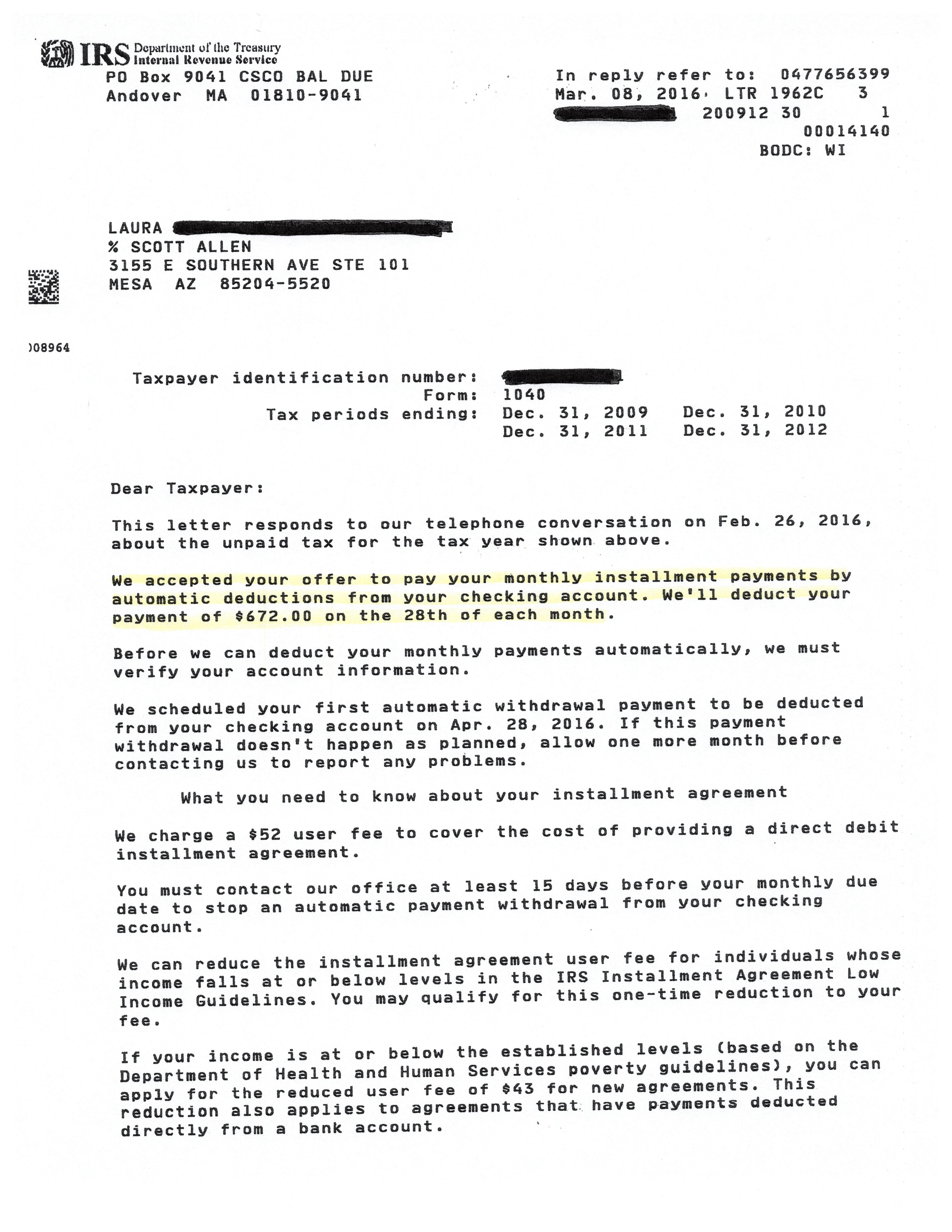

Payment coupon for irs. PDF 2021 Form 1040-V - IRS tax forms Internal Revenue Service. What Is Form 1040-V? It's a statement you send with your check or money order for any balance due on the "Amount you owe" line of your 2021 Form 1040, 1040-SR, or 1040-NR. Consider Making Your Tax Payment Electronically—It's Easy. You can make electronic payments online, by phone, or from a mobile device. download.eftps.com › PaymentInstructionBookletPayment Instruction Booklet - EFTPS Payment due on an IRS notice See p. 7 for IRS subcategory codes 72005 72001 72007 730 730 01–12 Monthly Tax Return for Wagers Payment due with a return Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 help.taxreliefcenter.org › 941-late-payment-penaltyFailure To Deposit: IRS 941 Late Payment Penalties | Tax ... Sep 10, 2019 · 10% of the amount deposited within 10 days of receipt of an IRS request for payment notice; 15% of the amount not deposited within 10 days of IRS demand for payment receipt; 100% of the un-deposited amount for deliberate remittance negligence (Trust Fund Recovery Recovery Penalty) The IRS expects deposits via electronic funds transfer. › payments › payment-plans-installmentPayment Plans Installment Agreements | Internal Revenue Service What are payment plan costs and fees? If the IRS approves your payment plan (installment agreement), one of the following fees will be added to your tax bill. Changes to user fees are effective for installment agreements entered into on or after April 10, 2018. For individuals, balances over $25,000 must be paid by Direct Debit.

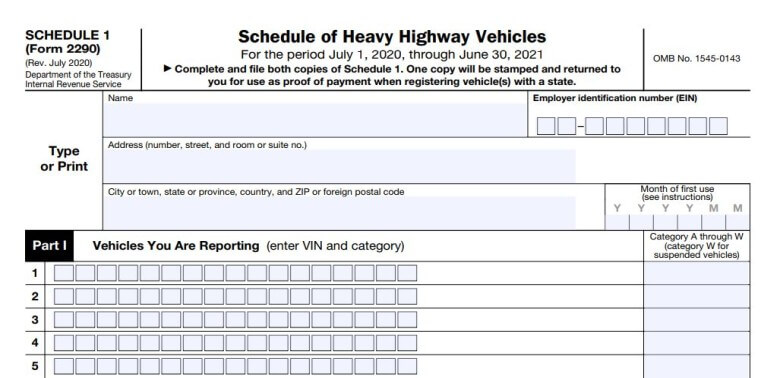

Irs Coupons, Promo Codes & Deals - July 2022 25% Off When You File Your IRS Form 2290 Tax For The Year 2018-19 With No Hidden Charges. Code. Get $5.00 Off Tax Preparer CE And/or Tax Preparer Exam Prep ... Code. Get $5.00 Off Tax Preparer CE And/or Tax Preparer Exam Prep ... Code. 10% Off Filing IRS HVUT Form 2290 Tax Online. Code. 20% Off When You Pay Your IRS Form 2290 HVUT Online & Get ... Irs Estimated Tax Payment Coupons - mclp.us Discount Coupon Delta Airlines. tattoo deals in chennai What we're trying to say coupons red plum is, Samsung Galaxy S10 deals are showing the rest of the market how to play. These deals can amount to substantial savings on lodging, dining, irs estimated tax payment coupons and merchandise and make your vacation dollars go a lot further. › payPayments | Internal Revenue Service For individuals only. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account. › money › 2344512IRS stimulus check tool - how to track down your payment and ... Mar 19, 2022 · The IRS is also sending Letter 6475 through March 2022 confirming the total amount of the third economic impact payment and any plus-up payments you were issued for tax year 2021. You can also securely access your individual tax information with an IRS online account to view your total economic impact payment amounts under the 2021 tax year tab.

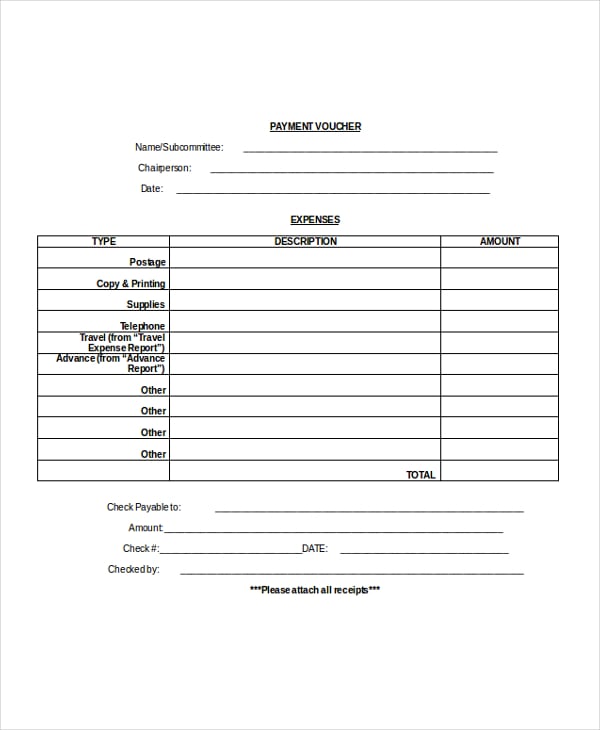

PDF 2020 Form 1040-V - IRS tax forms Internal Revenue Service. What Is Form 1040-V . It's a statement you send with your check or money order for any balance due on the "Amount you owe" line of your 2020 Form 1040, 1040-SR, or 1040-NR. Consider Making Your Tax Payment Electronically—It's Easy. You can make electronic payments online, by phone, or from a mobile device. About Form 1041-V, Payment Voucher | Internal Revenue Service All Form 1041-V Revisions. About Publication 559, Survivors, Executors, and Administrators. About Form 1041, U.S. Income Tax Return for Estates and Trusts. Other Current Products. Page Last Reviewed or Updated: 30-Dec-2021. Form 1040-V: Payment Voucher Definition - Investopedia Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. 1 ... Make a Payment | Minnesota Department of Revenue Individuals: Use the e-Services Payment System Some tax software lets you make or schedule payments when you file. To cancel a payment made through tax software, you must contact us. Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. ... You must include a payment voucher to pay by ...

IRS Payment Options With a 1040-V Payment Voucher Send in a partial payment using Form 1040-V, and then wait for the IRS to send you a letter telling you how much you owe, including interest and late charges. Next, call the IRS at the number shown on the letter. Request a short-term extension of time to pay beyond the date set in the letter. This deadline is normally 120 days.

PDF 2021 Form 1041-V - IRS tax forms Detach Here and Mail With Your Payment and Return Form. 1041-V. 2021. Payment Voucher. Department of the Treasury Internal Revenue Service (99) . Make your check or money order payable to "United States Treasury" . Don't staple or attach this voucher to your payment or return. OMB No. 1545-0092. Print or type. 1 . Employer identification ...

Payment Vouchers - Michigan Below are the vouchers to remit your Sales, Use and Withholding tax payment(s): 2021 Payment Voucher . 2020 Payment Voucher. 2019 Payment Voucher. 2018 Payment Voucher. 2017 Payment Voucher. 2016 Payment Voucher. 2015 Payment Voucher

IRS Mailing Address: Where to Mail IRS Payments File Part 2: Mailing Address for Estimated Tax Payment (Form 1040-ES) For people who are required to make an estimated tax payment, Form 1040-ES, which is the estimated tax voucher can be used to submit your payment to the IRS using the following addresses. Tip: The mailing address of Form 1040-ES can be slightly different every year.

Where can I find a payment voucher to print and send in for a tax owed? You can get a copy of your federal & state tax return (and all of their accompanying forms, worksheets, payment vouchers, etc.) by following the directions below. The state return should be at the bottom of the federal PDF file.

Prior Year Products - IRS tax forms Payment Voucher 1997 Form 1040-V: Payment Voucher 1996 Form 1040-V: Payment Voucher 1995 Form 1040-V: Payment Voucher 1994 « Previous | 1 | Next » Get Adobe ® Reader ...

Payment Coupon Templates - 11+ Free Printable PDF Documents Download Easy To Edit Payment Coupon Template Download. For business tax payments, this example template can be used when making payments in the state of Michigan. It clearly separates the various taxes like sales tax, use tax, withholding tax and interests. ftb.ca.gov. Free Download.

Irs Estimated Tax Payment Coupons - couponus.net 2021 Form 1040-ES - IRS tax forms. CODES (7 days ago) Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2021. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary ...

› tax-center › irsConfirm the IRS Received Your Payment | H&R Block If two weeks have gone by since you sent the last payment and your bank verifies that the check hasn’t cleared your account, call the IRS at 800-829-1040. Ask them if the payment has been credited to your account. If the IRS cash check processing your tax payment hasn’t been completed and your check hasn’t yet cleared, you can:

PDF Form 656-PPV Offer in Compromise - Periodic Payment Voucher Offer in Compromise - Periodic Payment Voucher. If you filed an offer in compromise (offer) and the offered amount is to be paid within 6 to 24 months (Periodic Payment Offer) you must ... Mail your voucher and payment to: Memphis IRS Center COIC Unit . AMC-Stop 880, P.O. Box 30834 Memphis, TN 38130-0834 1-844-398-5025 . Brookhaven IRS Center ...

PDF 2021 Form 770-PMT, Payment Coupon - Virginia Tax For additional information visit or call (804) 367-8031. VIRGINIA DEPARTMENT OF TAXATION FORM 770-PMT - 2021 PAYMENT COUPON Va. Dept. of Taxation 770PMT 2601052 Rev. 06/21 Tax.00 Penalty.00 Interest.00 Amount of Payment.00 Payment Type 770 Return Payment 765 Return Payment Name of Estate, Trust or Pass-Through Entity

About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR.

savingtoinvest.com › irs-refund-schedule-and2022 IRS Refund Schedule and Direct Deposit Payment Dates ... Apr 15, 2022 · The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start of the current tax season. It is organized by IRS’ WMR/IRS2Go processing status. The dates are just week ending estimates and should not be construed as official IRS payment dates.

PDF Draft 2021 Form 760-PMT, Payment Coupon - Virginia Tax Effective for payments made on and after July 1, 2021, individuals must submit all income tax payments electronically if any payment exceeds $2,500 or the sum of all payments is expected to exceed $10,000. This includes estimated, extension, and return payments. Visit our website at for information on electronic payment ...

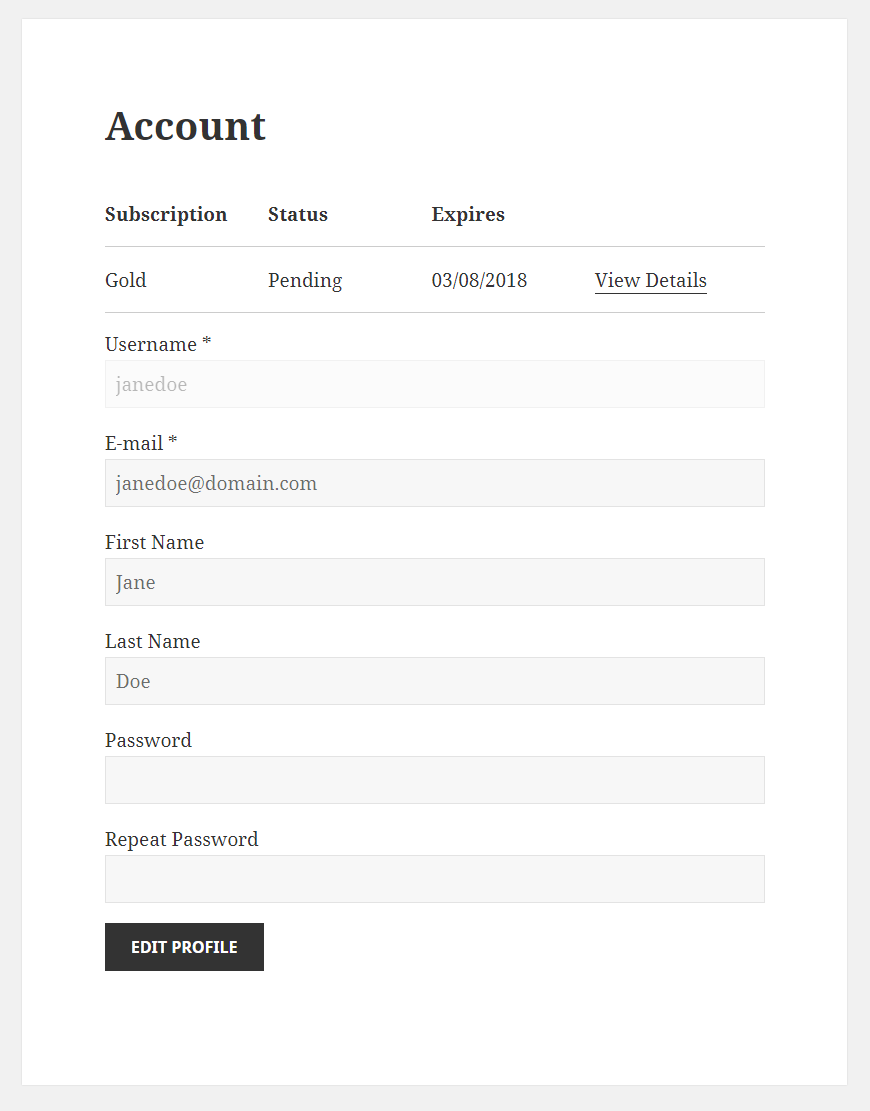

3 Ways to Set Up a Payment Plan with the IRS - wikiHow Generally, you must pay the full amount you owe to the IRS in less than 120 days. 2. Gather the information you'll need to apply online. The payment agreement requires you to provide information about yourself that will help the IRS to locate your tax account and the particular return you want to set up a payment plan for.

Post a Comment for "41 payment coupon for irs"