39 zero coupon bond journal entry

› capital-leaseCapital Lease: What is Capital Lease and How Does It Work? For example, if the present value of the lease payments amounts to $50,000 then $50,000 is going to be debited to the relevant asset account, whereas the corresponding credit entry of $50,000 is going to be made in the liability account. The main objective here is to capitalize on the leased asset. This is summarized in the following journal entry: Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Zero Coupon Bond Questions and Answers | Study.com 1. Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $91.20. while a 2-year zero sells at $82.48. You are considering the purchase of a 2-year-maturity bond making ...

Zero coupon bond journal entry

Zero Interest Bonds | Formula | Example | Journal Entry - Accountinguide Please prepare the journal entry during issuing and the annual interest expense. As the company issue bonds at zero interest rate, we need to calculate the selling price first. Selling price = $ 100/ (1+6%)^5 = $ 74.72 Company needs to sell bonds at $ 74.72 per bond. So the company will receive the cash of $ 74,270 for selling 1,000 bonds. Accounting Zero Coupon Bonds Journal Entries Accounting Zero Coupon Bonds Journal Entries - ... Accounting Zero Coupon Bonds Journal Entries, Truck Lease Deals August 2020, Coupon For Celeb Boutique, Caress Body Wash Coupons 2020, About Faces Day Spa Coupons, Coupons Office Max 2019, Lee Valley Cyber Monday Deals 2019 en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

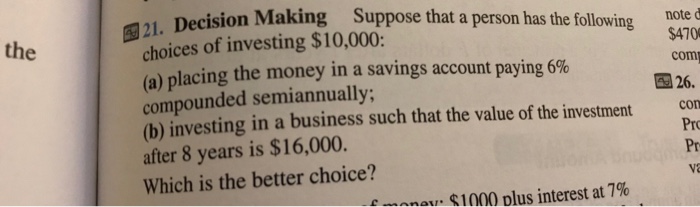

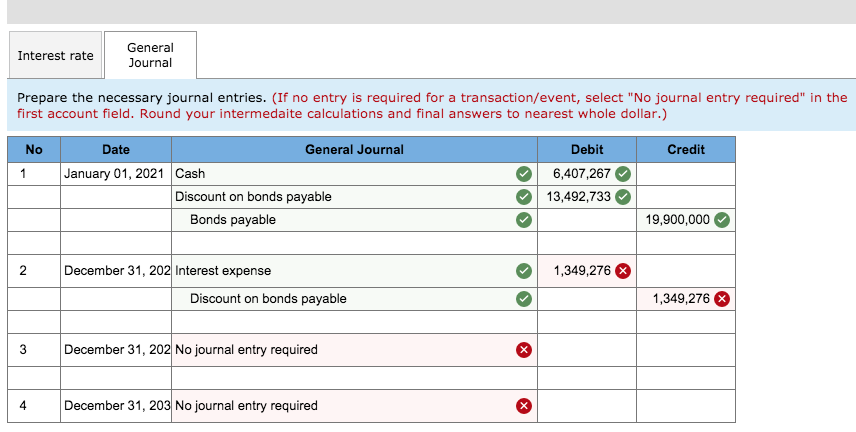

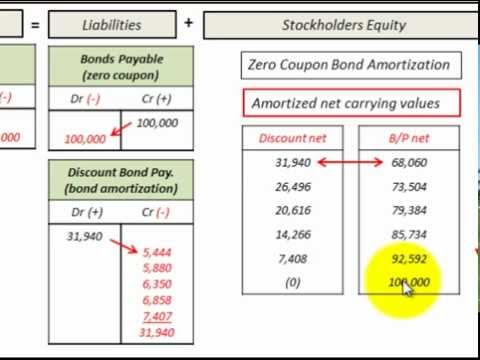

Zero coupon bond journal entry. Accounting for Zero-Coupon Bonds - 2012 Book Archive Prepare journal entries for a zero-coupon bond using the effective rate method. Explain the term "compounding." Describe the theoretical problems associated with the straight-line method, and identify the situation in which this method can be applied. The Issuance of a Zero-Coupon Bond fountainessays.comFountain Essays - Your grades could look better! 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Deferred Coupon Bond | Formula | Journal Entry - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. Please calculate the bond price that company needs to sell to attract investors. accountinguide.com › investment-in-bondsInvestment in Bonds | Journal Entry | Example - Accountinguide When the bond is redeemed by the issuer at the end of its maturity; Solution: On January 1, 2020. When the company ABC purchases the bond for $10,000 at its face value, it can make the investment in bonds journal entry on January 1, 2020, as below:

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... 14.4 Pricing and Reporting Term Bonds - Financial Accounting Prepare all journal entries for a term bond when the stated cash interest rate is different from the effective interest rate. Question: Although zero-coupon bonds are popular, notes and most bonds actually do pay a stated rate of cash interest, one that is specified in the contract. ... Earlier, with the zero-coupon bond, the entire amount of ... Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... Accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cas... Convertible zero-coupon bonds - journal entry - Ask Me Help Desk Code: PV = $639 million x (1 + 0.5%)^ (-30) = $550 million which is equal to the gross proceeds that were collected, as expected. Focusing on the convertible characteristic, the conversion ratio is 9.4602 as stated. By definition, every Y dollars of Convertible Notes a bondholder receives 9.4602 shares and each share has a conversion price P.

Journal Entry for Zero Coupon Bonds | Accounting Education Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. It means Mr. David bought it at $ 16529 at 10% per year his earning. At the end of second year, company has to pay only face value of $ 20000. Zero Coupon Bond These bonds are issued with a coupon. The periodic ... Textbook solution for Intermediate Accounting 9th Edition J. David Spiceland Chapter 14 Problem 14.2BYP. We have step-by-step solutions for your textbooks written by Bartleby experts! 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000. Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

Zero-Coupon Bond Yield - Harbourfront Technologies A zero-coupon bond with a face value of $1,000 has five years to maturity. The current price of the bond is $900 in the market. Therefore, the following formula can help in the calculation of the zero-coupon bond yield. Zero-Coupon Bond Yield = [Face Value / P]^1/n - 1. Zero-Coupon Bond Yield = [$1,000 / $900]^ (1/5) - 1.

Journal Entries of Zero Coupon Bonds - YouTube Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy g...

accountinguide.com › accounting-for-bondsAccounting for Bonds | Premium | Discount | Example ... Journal entry at the end of first year: On 31 Dec 202X, Company records debit interest expense of $ 7,588 ($ 94,846 * 8%), credit cash paid $ 6,000 and Discount bonds payable $ 1,588. Company record interest expense base on the market rate but pay to investor base on coupon rate, so the different will credit bond discount which will be zero at ...

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

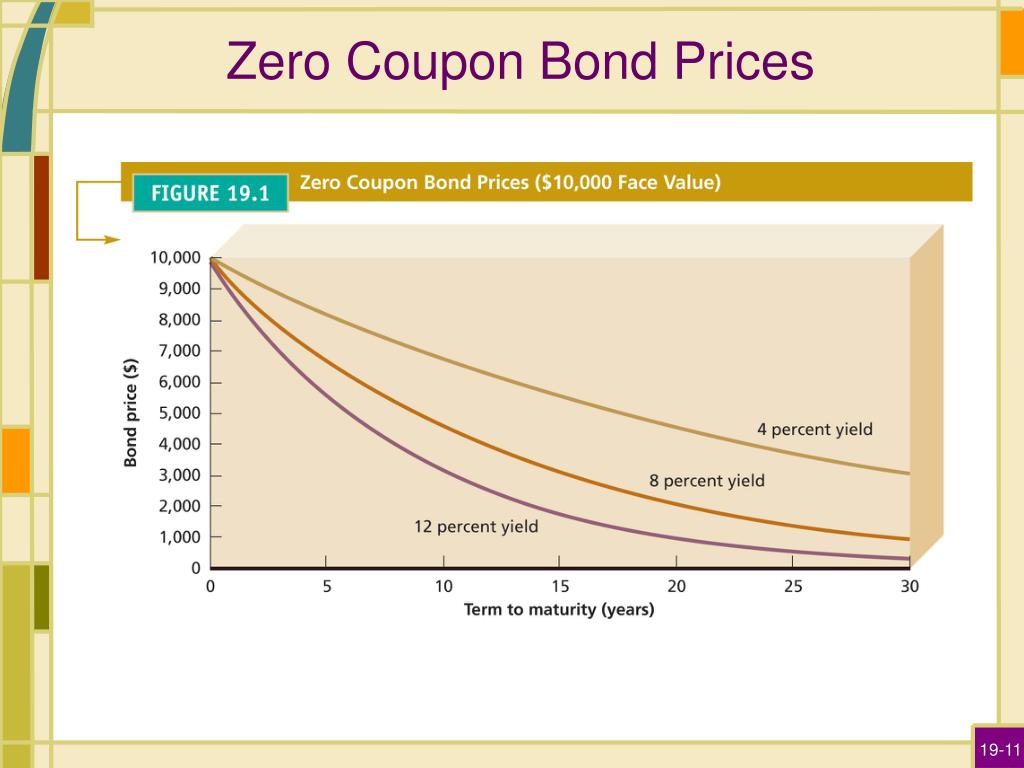

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero coupon bond definition — AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds

Zero Coupon Bonds - Accounting Video | Clutch Prep Practice: On January 1, ABC Company issues $1,000,000 of zero coupon bonds at 75. The bonds mature in five years. Assuming that ABC uses the straight-line method for amortization of bond premiums and discounts, the journal entry at the end of the first year would include:

xplaind.com › 695414Amortized Cost of Financial Assets and Liabilities | Example Oct 31, 2020 · Amortized cost is an investment classification category and accounting method which requires financial assets classified under this method to be reported on balance sheet at their amortized cost which equals their initial acquisition amount less principal repayment plus/minus amortization of discount/premium (if any) plus/minus foreign exchange differences (if any) less impairment losses (if any).

› dictionary › bondBond Definition & Meaning - Merriam-Webster bond: [verb] to lap (a building material, such as brick) for solidity of construction.

Journal Entry for Bonds - Accounting Hub Therefore, the journal entry for semiannual interest payment is as follow: This interest payment will start from June 30, 2020, until December 31, 2039. At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders.

Zero-Coupon Bond - an overview | ScienceDirect Topics Zero-coupon bonds linked to the inflation do not pay coupons. Therefore, the unique adjustment is made to the principal. These types of bonds offer no reinvestment risk due to the absence of coupon payments and have the longest duration than other inflation-linked bonds. The value is given by Equation (6.8): (6.8) P I L = M I L 1 + r N

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

Accounting for Issuance of Bonds (Example and Journal Entry) Suppose ABC company issues a bond at a par value of $ 100,000 and a coupon rate of 5% with 5 years maturity. The market interest rate is also 5%. Let us calculate the PV of bond principal payment and interest component first. PV of bond = $ 100,000 × (0.78355) = $ 78,355. PV Factor 5%, 5 years = 0.78355. Coupon/Interest = $ 100,000 × 5% ...

Accounting Deep Discount Bonds - I GAAP & IFRS - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

Pre-funded Coupon and Zero-Coupon Bonds: Cost of Capital ... - SpringerLink Pre-funded coupon bonds have been developed and sold by investment bankers in place of zero-coupon bonds to raise funds for companies facing cash flow problems. ... An Innovation," Journal of Portfolio Management, 9-19. Google Scholar. Myers, S.C., 1984, "The Capital Structure Puzzle," Journal of ... Cite this entry as: Srivastava S ...

en.wikipedia.org › wiki › Mortgage-backed_securityMortgage-backed security - Wikipedia Just as this article describes a bond as a 30-year bond with 6% coupon rate, this article describes a pass-through MBS as a $3 billion pass-through with 6% pass-through rate, a 6.5% WAC, and 340-month WAM. The pass-through rate is different from the WAC; it is the rate that the investor would receive if he/she held this pass-through MBS, and ...

Post a Comment for "39 zero coupon bond journal entry"