39 coupon rate and ytm

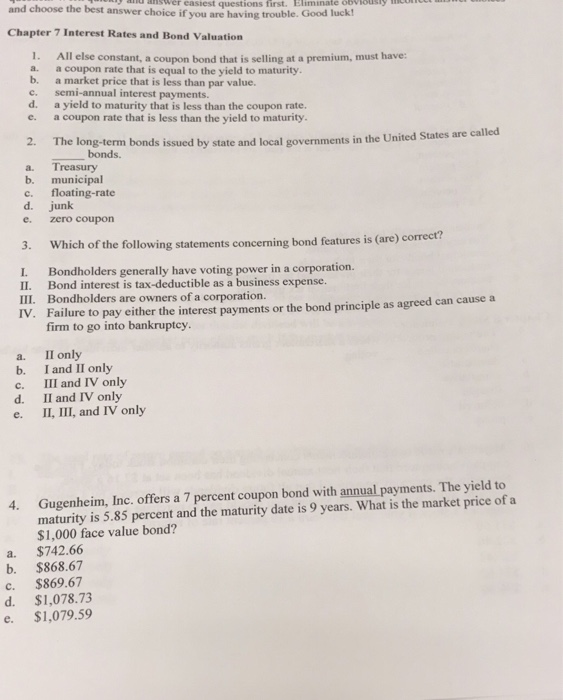

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ... Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube Description. In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the yield to maturity formula.

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Coupon rate and ytm

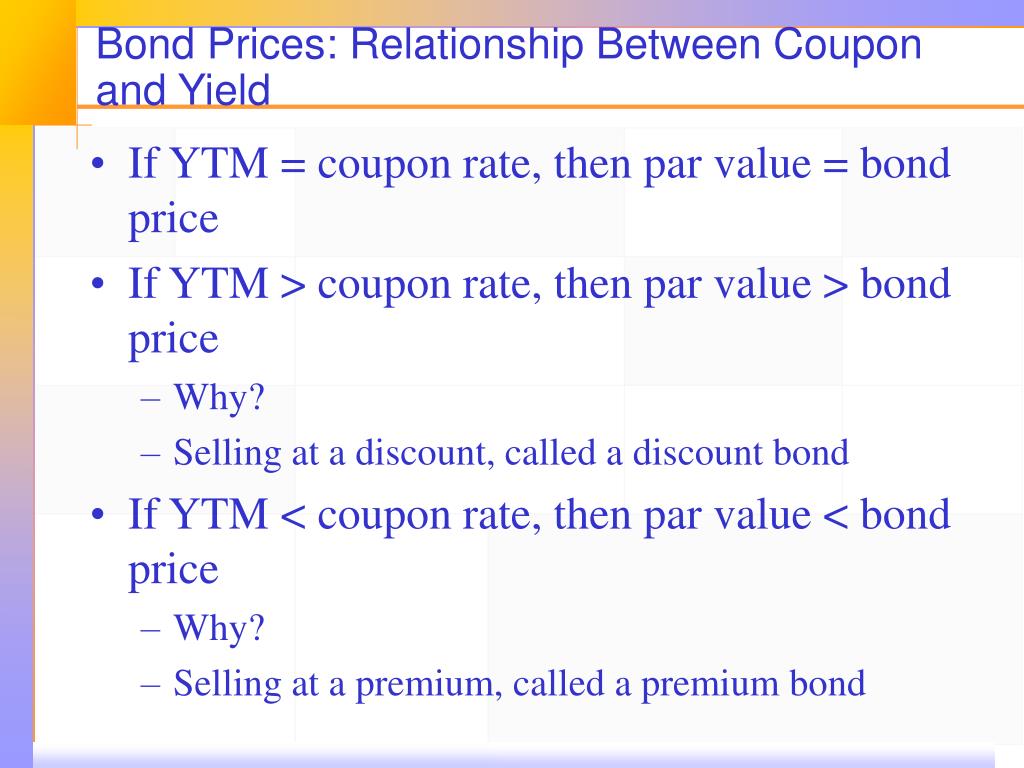

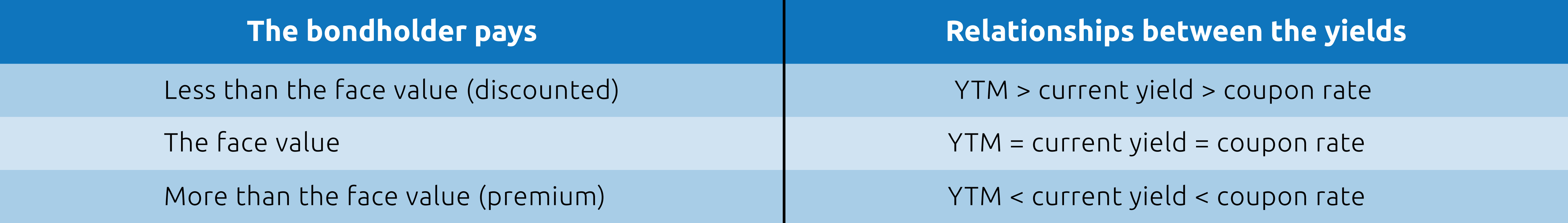

Important Differences Between Coupon and Yield to Maturity Coupon tells you what the bond paid when it was issued, but the yield to maturity tells you how much it will pay in the future, and that's important. ... Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only ... yield to maturity 和 coupon rate有什么区别_百度知道 coupon rate是票面利率,也是息票率,指印制在债券票面上的固定利率,通常是年利息收入与债券面额之比率,又称为名义收益率、票面收益率;. yield to maturity是到期收益率,又称最终收益率,是指在假设在投资收益率保持与YTM一样的情况下,所有的息票和本金收入向当期时刻折现,使得其现值正好等于目前的市场价格(初期需投资金额)的贴现率。. 其次是计算标准上的 ... ytm和discount rate的区别是什么? - 知乎 - Zhihu YTM matters more to a bond trader, and coupon rate matters more to an investor. At the time of purchase, the two are the same. For a bond trader, there is potential P/L generated by market price change. If bond is purchased at par/face value, YTM = coupon rate; If purchased at a discount, YTM > Coupon rate; If purchased at a premium, YTM ...

Coupon rate and ytm. coupon rate, YTM, current rate 三者的大小关系_百度知道 这是用Excel求出来的三种情况:当coupon rate>YTM时,Face Value购买价格当coupon rate 购买价格当coupon rate=YTM时,Face Value=购买价格。coupon是票息率。yield是收益率。债券收益率是使得债券现金流的贴现值等于债券市场价格的贴现率。 Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate. A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. Yield to Maturity (YTM) - Meaning, Formula and Examples This indicates that the YTM is lesser than the coupon rate. Current Yield. YTM is one of the ways that a bond yield can be represented and is useful to investors. Yield can also be represented in the form of current yield. Let's again look at our yield to maturity example to understand what is the current yield. Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

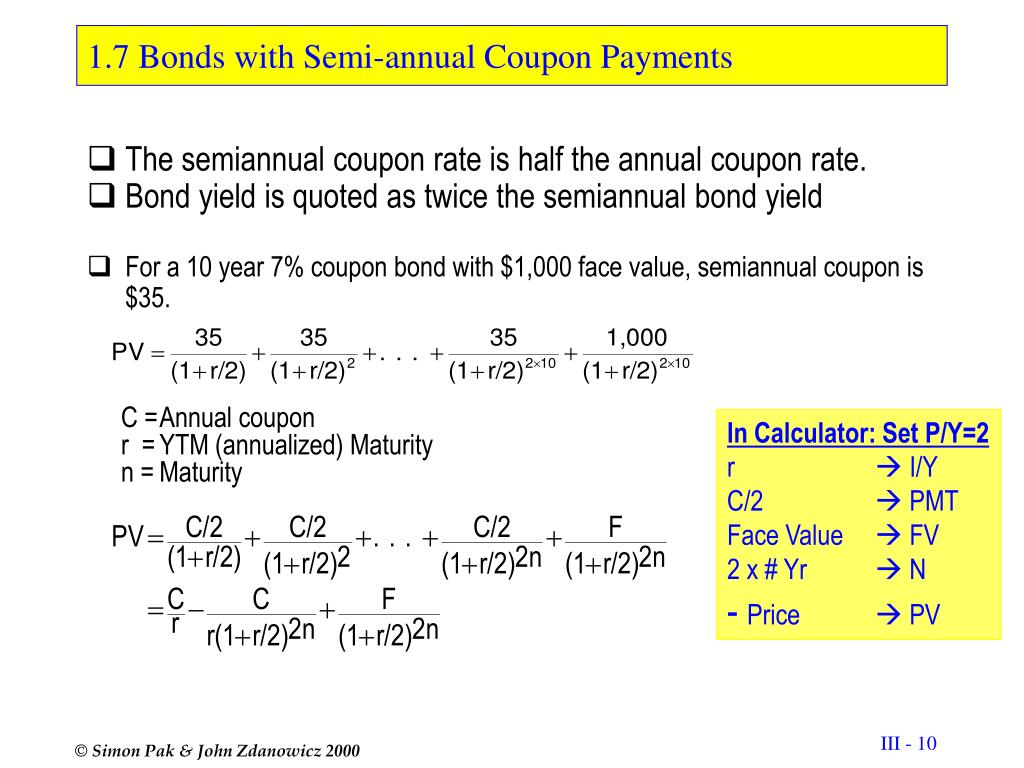

What is the difference between the YTM and the coupon rate? Answer (1 of 4): The coupon rate is the annual amount of interest a bond pays and it is fixed on the day the bond is issued for $1000. So a 5% coupon, 10-year bond will pay $50 per year for the life of the bond, no matter whether the price of that bond goes up or down between the issue date and ... Yield to Maturity (YTM) - Overview, Formula, and Importance What is the Yield to Maturity (YTM)? Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security, such as a bond. The YTM is based on the belief or understanding that an investor purchases the security at the current market price and holds it until the security has matured (reached its full value), and that all interest and coupon payments are made in a timely fashion. Yield to Maturity Calculator | Calculate YTM coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and; n - Years to maturity. Let's take Bond A issued by Company Alpha, which has the following data, as an example of how to find YTM: Bond price: $980; Face value: $1,000; Annual coupon rate: 5%; Coupon Frequency: Annual; Years to maturity: 10 years Bond Yield Formula | Calculator (Example with Excel Template) Therefore, for the given coupon rate and market price, the YTM of the bond is 3.2%. Bond Yield Formula - Example #2 Let us take the example of a 5-year $1,000 bond that pays a coupon rate of 5%.

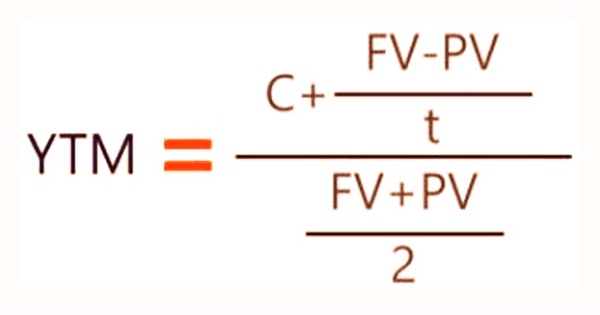

Difference between YTM and Coupon Rates The formula for calculating YTM is as follows: YTM = [ (C/P) (1/n)]- [ (1+ (C/P))^ (-nYTM)] in which C equals annual coupon payments, P equals the price of the bond, n equals a number of compounding periods per year, and t equals a number of years until maturity. Coupon Rate - Meaning, Calculation and Importance - Scripbox The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond. YTM AND ITS INVERSE RELATION WITH MARKET PRICE | India Scenario 1: interest rates rose to 8.0% Increased interest rate will drive the coupon rate (8.0%) on the newly issued bonds to be higher than the coupon rate on the existing bonds (7.5%). This will lead to an increase in the YTM of the existing bond, which now equates to YTM on the newly issued bond, being 8.0%; while the market price of the ... Coupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

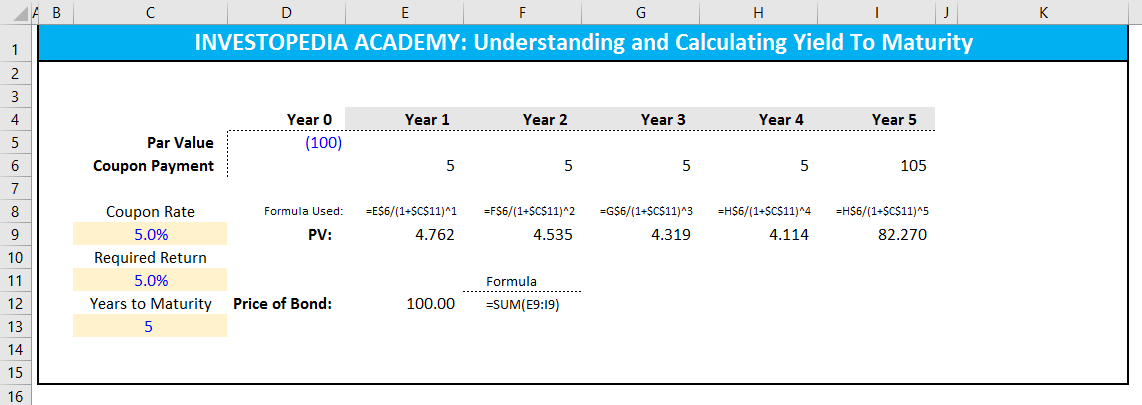

Bond Pricing Formula |How to Calculate Bond Price? - EDUCBA Where. n = Period which takes values from 0 to the nth period till the cash flows ending period C n = Coupon payment in the nth period; YTM = interest rate or required yield P = Par Value of the bond Examples of Bond Pricing Formula (With Excel Template) Let's take an example to understand the calculation of Bond Pricing in a better manner.

› yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year, whereas yield of maturity changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

Coupon Rate Formula | Step by Step Calculation (with Examples) Finally, the coupon rate is calculated by dividing the total annual coupon payment by the par value of the bond and multiplied by 100%, as shown above. ... The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value.

Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author.

Coupon Rate Calculator | Bond Coupon As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond investments if you hold them ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact yield to maturity formula are inside. Search for: ... Annual Coupon Rate: 10%; Coupon Frequency: 2x a Year; 100 + ( ( 1000 - 920 ) / 10) / ( 1000 + 920 ) / 2 = 100 + 8 / 960 = 11.25%.

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia The yield to maturity (YTM), book yield or redemption yield of a bond or other fixed-interest security, such as gilts, is an estimate of the total rate of return anticipated to be earned by an investor who buys a bond at a given market price, holds it to maturity, and receives all interest payments and the capital redemption on schedule.

Post a Comment for "39 coupon rate and ytm"